foreign gift tax return

If you are a US. Form 3520 is technically referred to as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

Because the gift came from your dad despite how he needed help from others to facilitate the transfer.

. Learn How EY Can Help. If an automatic 2-month extension applies for the US. Form 3520 is an informational return in which US.

Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. Persons who receive gifts from a non-resident alien or foreign estate totalling more than. Learn How EY Can Help.

Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse. The tax applies whether or not. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

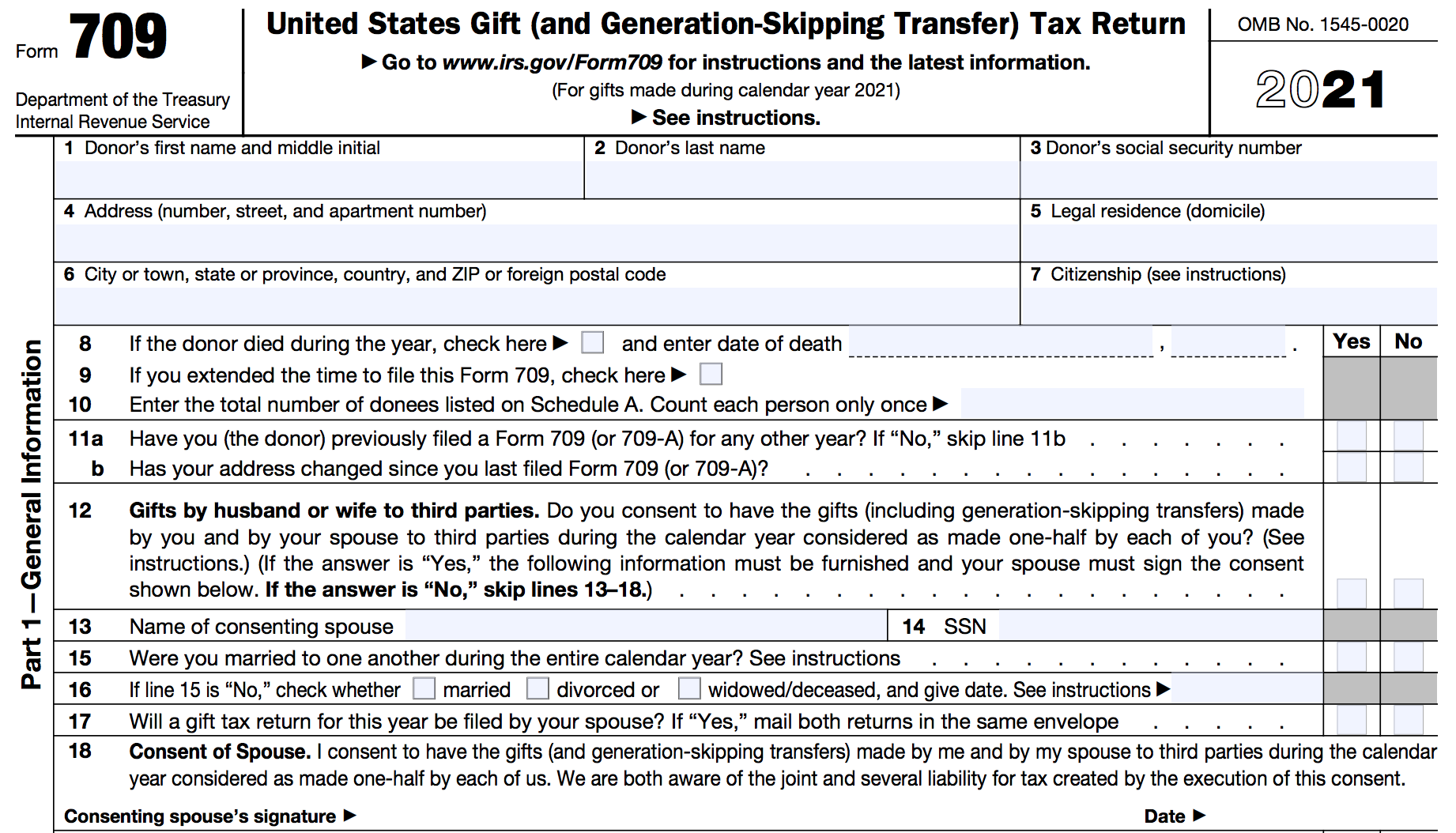

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift tax you must file a gift tax return Form 709 if. You gave any gifts of future interests Your gifts of.

Persons who must file this form. Browse discover thousands of brands. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Taxpayers report transactions with certain foreign trusts ownership of foreign trusts and receipts of large gifts from foreign entities. Form 3520 Filing Requirements. Tax ramifications on the initial receipt of a gift from a.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and. If the value of those gifts to any one person exceeds 15000 you need to file.

Examples of Foreign Gift Reporting Tax Example 1. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. This value is adjusted.

It doesnt matter if the gift is to a US. Even though there are no US. For gifting purposes there are three key categories of US.

Ad Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. Read customer reviews find best sellers.

Ad Helping Businesses Navigate Various International Tax Issues. Persons may not be aware of their requirement to file a Form 3520. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Citizen or resident alien the rules for filing income estate and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. Ad Helping Businesses Navigate Various International Tax Issues. Tax on Gift with No Income.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than. The tax applies whether or not the donor.

Person or a foreign person or if the giftproperty is in the US. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options.

Form 3520 is used to report the existence of a gift trust or inheritance received from foreign persons.

Gifts From Foreign Persons New Irs Requirements 2022

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Cra T1135 Forms Toronto Tax Lawyer

6 Surprising Facts Found In Presidential Tax Returns Through History History

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

Complying With New Schedules K 2 And K 3

How To Fill Out A Fafsa Without A Tax Return H R Block

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Gifting Money To Family Members Everything You Need To Know

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

20 1 9 International Penalties Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Gifts From Foreign Persons New Irs Requirements 2022

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Are College Scholarships And Grants Taxable Forbes Advisor

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management